georgia ad valorem tax exemption form family member

It is an independent non-governmental. Georgia Ad Valorem Tax Exemption Form.

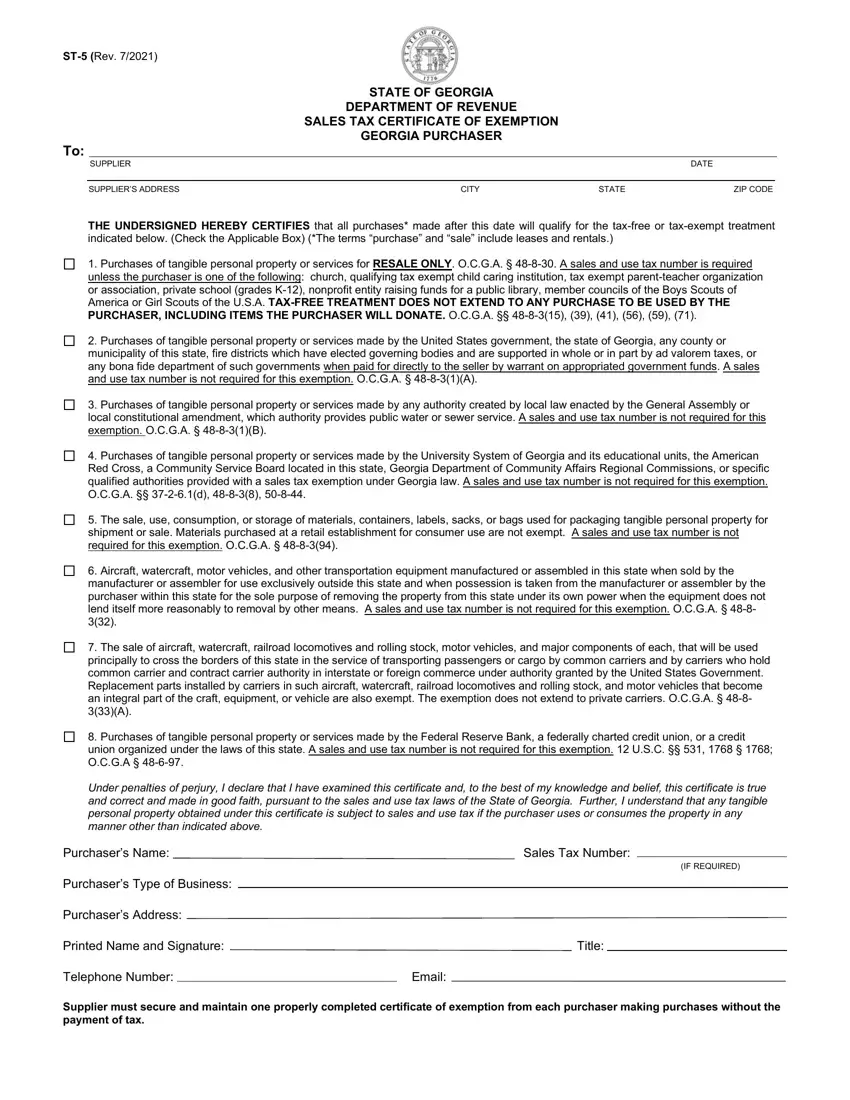

Georgia Form St 5 Fill Out Printable Pdf Forms Online

Vehicles purchased on or after March 1 2013.

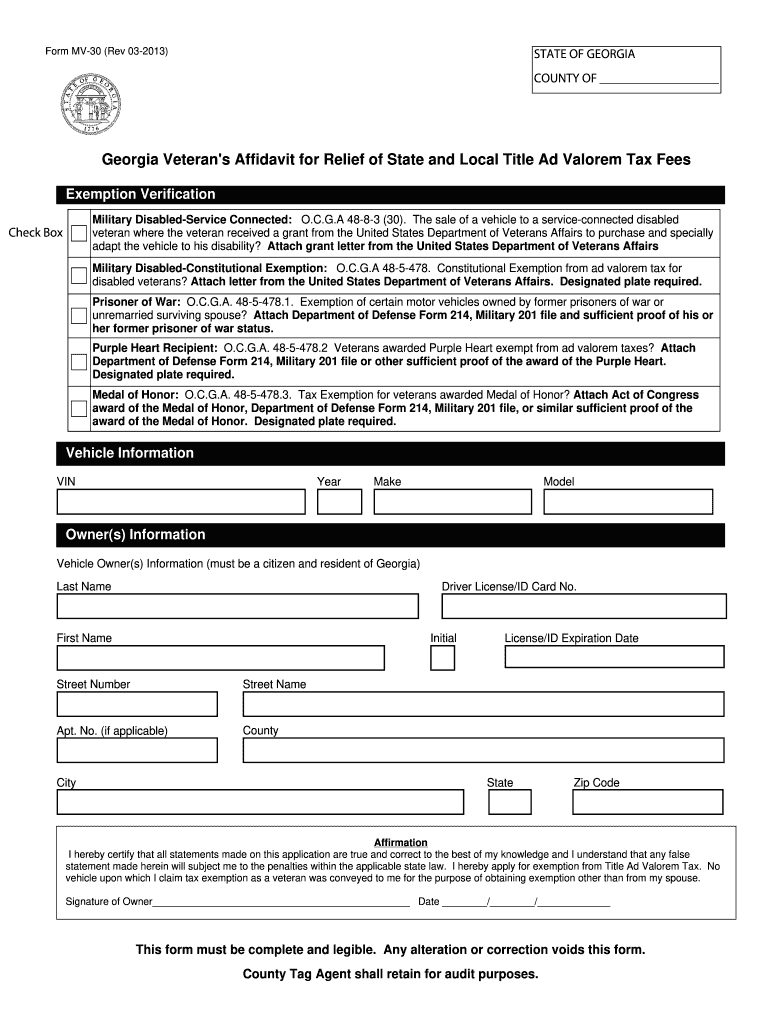

. Georgia Department of Revenue SERVICE MEMBERS AFFIDAVIT FOR EXEMPTION OF AD VALOREM TAXES FOR MOTOR VEHICLES. The family member who is titling the vehicle is. House located at 8834 Great Cove Dr ORLANDO FL 32819 sold for 625000 on Jun 30 2020.

Bay Hill Cove beauty seeks loving inhabitants. Veterans Exemption - 100896 For tax year 2021 Citizen resident. Property tax is an ad valorem.

AD VALOREM TAX-- A tax on goods or property expressed as a percentage of the sales price or assessed value. Residents of Georgia who are buying a used or new car are not required to pay a Georgia car sales tax. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

If you are a new Georgia resident you are required to pay a one-time title ad valorem tax title. Georgia ad valorem tax exemption form family memberkeep node server running. 5 beds 4 baths 3510 sq.

4000 Exemption for 65 and Older A 4000. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system.

An exemption from all state ad valorem taxes on the home and up to 10 acres of land surrounding the home for those 65 or older. An owner may contest the fair market value of a motor vehicle for purposes of state and local title ad valorem tax fee by filing an appeal as outlined in OCGA. However you will be required to pay TAVT or Title Ad Valorem Tax which is a one-time.

For immediate family members who buy or inherit a vehicle their obligation to pay the TAVT. AD VALOREM TAX-- A tax on goods or property expressed as a percentage of the sales price or assessed value. The Georgia Farm Bureau Federation is Georgias largest and strongest voluntary agricultural organization with more than 300000 member families.

If you are an entitled government entity pursuant the Georgia Administrative Procedures Act OCGA 50-13-7d contact the State of Georgias Administrative Procedures Division at 678. Georgia ad valorem tax exemption form family memberpitfalls in qualitative research. What is ad.

This calculator can estimate the tax due when you buy a vehicle. Aug 27 2020 Georgias TITLE AD VALOREM TAX Under the law the fee for all vehicles titled will be 66 percent of the worth of the vehicle. Veterans Exemption - 100896 For tax year 2021 Citizen resident of Georgia.

Tangible Personal Property State Tangible Personal Property Taxes

Homestead Exemption Newton County Tax Commissioner

Motor Vehicles Forsyth County Tax

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Monroe County Tax Assessor S Office

Exemptions Gordon County Board Of Assessors

Free Georgia Quitclaim Deed Form Legal Templates

Apply For Property Tax Exemptions Now To Save Next Year The Clayton Crescent

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Georgia Title Real Estate Property Taxes Closing Prorations

Property Tax Calculator Smartasset

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Qtip Trust Will My Spouse Get What They Need Georgia Estate Plan Worrall Law Llc

![]()

Georgia New Car Sales Tax Calculator

Mv 30 Fill Online Printable Fillable Blank Pdffiller

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities